The energy sector in the USA is now grappling with rising financial instability, policy headwinds, and shaken consumer confidence. Its recent example is the bankruptcies of Sunnova Energy International (a residential solar service provider) and Mosaic Inc. (a solar financing platform). These are more than isolated corporate failures.

Remember, these companies are not minor players; they are household names. Their sudden downfall has sparked tough questions: Is this just a temporary setback, or a warning sign for the future of rooftop solar?

These collapses are happening at a time when climate policy, energy independence, and affordability are top national concerns. This situation can cause uncertainty for homeowners. It is now becoming increasingly important to choose the right solar partner.

Not every VA Solar company operates the same way, and many local and regional providers offer stronger customer service, more transparent financing, and long-term stability. By working with a trusted, well-reviewed company, homeowners can still enjoy the benefits of solar without the risk of being left in the dark.

Let’s understand the reason behind these bankruptcies and the deeper issues they expose.

Here’s an overview of Sunnova and Mosaic, along with a look at their financial downturns.

Sunnova is a primary U.S. based solar panel installation company for residential solar and energy storage founded in 2012 and headquartered in Houston, Texas. Over the years, it has deployed solar panels and battery storage systems to hundreds of thousands of homeowners, generating approximately $1.4 billion in revenue in 2023.

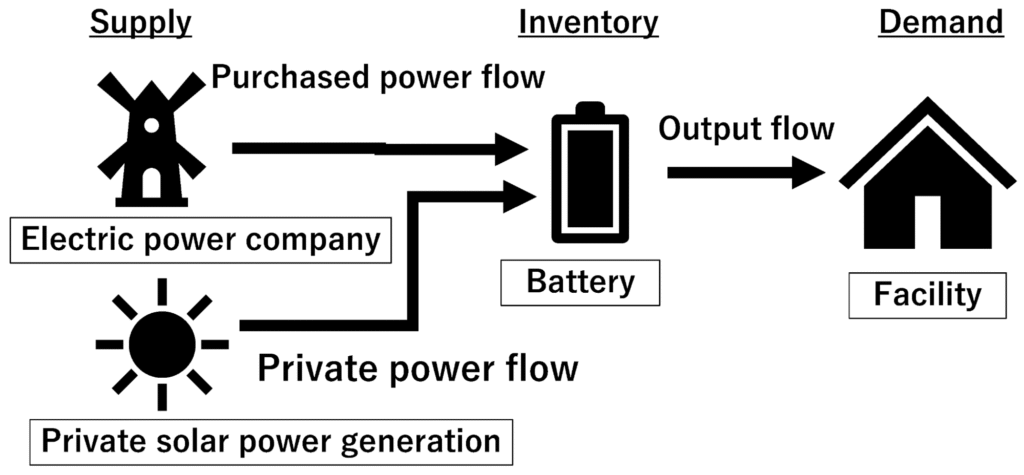

It operated on an “energy-as-a-service” model, offering solar installations with little to no upfront cost through leases, PPAs, or loans, bundled with maintenance and storage options.

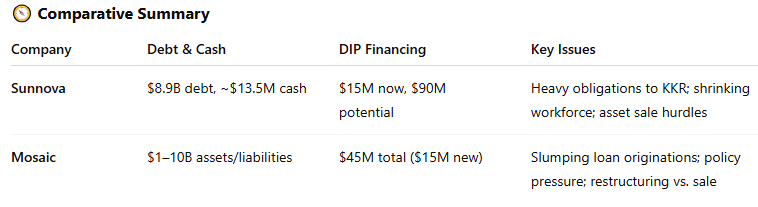

Despite earlier growth, by late 2024, Sunnova was warning about a “going concern”—cash flow issues, despite $8.5 billion in debt and only around $13 million in liquidity.

In June 2025, the solar installer company filed for Chapter 11 bankruptcy protection, citing $8.9–10.7 billion in debt and weak demand.

Aspect | Details |

|---|---|

Purpose | Debt restructuring to allow the business to continue operating |

Who Uses It | Primarily corporations and large firms (e.g., Sunnova, Mosaic) |

Operations Continue | Yes – company remains in control (often as “debtor in possession”) |

Creditor Protection | Legal pause on collections and lawsuits during reorganization |

Debt Plan | Court-approved repayment or restructuring plan over time |

Duration | Varies – can take months to years, depending on complexity |

End Result | Business either emerges stronger or convert to liquidation (Chapter 7) |

Investor Impact | Stock value often drops sharply or becomes worthless |

Public Signal | Seen as a sign of financial distress, but not necessarily failure |

Recently laid off over 700 employees (~55% of its workforce) and sold select assets to Atlas and Lennar Homes to stay operational under court supervision.

Founded in 2010 and based in Oakland, California, Mosaic is a fintech platform specialized in financing for residential solar and energy-efficient home improvements. The company originally used a crowdfunding model but later pivoted to providing low-rate installment loans via institutional capital.

Mosaic connects homeowners, solar installers, and capital partners. They offer 10–25-year loans that cover solar, storage, EV chargers, heat pumps, and more, rarely holding loans for long-term periods. It has originated over $15 billion in loans, serving more than 500,000 households.

Mosaic filed for Chapter 11 on June 6, 2025, due to steep declines in loan volume (residential solar loans dropped to record lows in 2024), tightened policy around tax credits, and rising interest rates.

It secured $45 million in debtor-in-possession financing from existing lenders (with $15 million in new funds approved), aiming to continue servicing loans while exploring restructuring and asset-sale options.

To understand how two major players ended up in this position, we need to examine the broader forces reshaping the rooftop solar landscape.

Chapter 11 filing: Sunnova formally filed on June 9, 2025, citing $8.9 billion in debt with just $13.5 million in liquidity.

DIP financing & asset sales: The court approved $15 million in interim debtor-in-possession financing (with up to $90 million total), plus the sale of assets to Apollo/Atlas and Lennar Homes for around $31 million to support ongoing operations.

Stumbling blocks: A $185 million high-interest loan from KKR, carrying 15% interest, came with tight controls on asset sales. Sunnova’s negotiations to limit that lender’s influence fell apart, prompting a special committee to explore legal challenges.

Layoffs and cuts: The company has cut over 700 jobs (about 55% of its workforce) and shut down a significant portion of its commercial arm before filing.

Chapter 11 filing: Mosaic initiated proceedings on June 6, 2025, reporting assets and liabilities in the $1–10 billion range in the Texas Bankruptcy Court.

Funding plan: Secured a $45 million DIP financing from existing lenders (including $15 million of new capital) to maintain operations and loan servicing functions.

Strategic objectives: The plan employs a dual-track approach, involving either restructuring under a supported plan or an asset sale through a Section 363 auction, with the intention of maximizing stakeholder value.

Market context: The filing came amid sharply rising interest rates, dwindling customer demand for solar financing, and uncertainty over tax credits.

The bankruptcies of Sunnova and Mosaic were not isolated events—they were the result of different factors. Let’s explore.

The sharp rise in interest rates is the main reason for this crisis. Both Sunnova and Mosaic relied heavily on cheap capital to offer long-term loans or leases with low monthly payments. It is an attractive proposition for homeowners.

As rates climbed from near-zero to multi-decade highs, the economics of solar financing began to unravel. Higher borrowing costs reduced investor appetite for solar-backed securities and made monthly payments less appealing to consumers.

Policy support has consistently played a significant role in making residential solar panels more affordable. But changes in some vital state policies are causing problems. For example, California’s new NEM 3.0 rules have made it less rewarding for homeowners to sell extra power back to the grid.

That means lower savings for many people who install solar panels. At the national level, the Inflation Reduction Act offers tax credits, but the rules around how those credits work—like who can use them and how—have been slow to roll out. This has made it more challenging for solar financing companies to plan and offer competitive deals.

Homeowners aren’t as excited about going solar right now because the savings take longer to add up, and the upfront benefits aren’t as strong as they used to be.

The economic uncertainty, coupled with inflation and high interest rates, has prompted many potential solar customers to postpone their installation decisions. It is not the right time to cancel these installations.

Mosaic reported a sharp drop in loan originations, while Sunnova cited “weaker-than-expected” demand across key markets in early 2025.

Note: To maximize the benefits of tax credit, consider installing solar panels for both your home and commercial property now. We, at Cosmo Solaris, are ready to help you with solar panel installation.

Both companies operated on growth-first models fueled by aggressive lending and partnerships with third-party installers. This left little margin for error when conditions tightened.

Sunnova’s massive debt load (nearly $9 billion) became unsustainable when capital dried up. Mosaic, acting more as a broker than a lender, found itself squeezed between investors seeking returns and consumers balking at high loan costs.

These pressures converged to create an environment where even well-established solar companies struggled to stay afloat.

The bankruptcies of Sunnova and Mosaic are more than just financial headlines. Here’s how the fallout is being felt:

Solar installers, equipment suppliers, and financing partners are all feeling the heat. When companies like Sunnova and Mosaic stumble, it disrupts cash flows, halts new projects, and shakes investor confidence.

Smaller solar installers who relied on Mosaic’s financing or Sunnova’s service contracts may struggle to stay afloat. Overall, it’s becoming harder for solar businesses to raise money, offer competitive financing, or scale up operations.

Homeowners are caught in the middle. Those who have already installed solar with these companies might be unsure who will service their systems or handle warranties. You should not worry, as many companies, such as Cosmo Solaris, can assist you. We are the Best solar company in Virginia, VA.

Don’t hesitate if you want to go solar because our solar installation system is quite transparent. Book a meeting with our experts to understand the reliability of our providers or the long-term value of their investment.

These bankruptcies could signal a turning point. The rooftop solar market may shift toward more cautious growth, with tighter lending standards and more scrutiny of business models. At the same time, this moment also pushes the industry to innovate, offering simpler, more transparent financing and better customer service.

At Cosmo Solaris, we promise long-term success, and we will do our best in terms of interest rate relief and other benefits.

The collapse of Sunnova and Mosaic highlights the fragility of the rooftop solar market in a tougher economic and policy environment. Rising interest rates, shrinking incentives, and weakening consumer demand have exposed cracks in even the most established business models.

But this isn’t the end of rooftop solar—it’s a wake-up call.

For the sector to recover and thrive, companies will need to adapt quickly:

Homeowners still want clean energy, but they need reassurance that going solar is a safe and worthwhile investment.

As the dust settles, the future of rooftop solar will depend not just on technology or climate urgency, but on smart business decisions, stable regulation, and a renewed focus on long-term value. As a trusted solar energy company, we are always there for your assistance.